As more and more companies are relocating business transactions on the internet, data breaches have also been increasing at an alarming rate during the past years. Some stolen data are being sold on the dark web, while some are being used for personal gains – you know anything people will do to get money the easy way.

Due to the increasing rate of data theft across the internet, business owners should double their security in protecting their customers’ data. Businesses must follow strict protocols for compliance to a Non-disclosure agreement; otherwise, there will be serious legal problems.

A point-of-sale system is very well known these days, as it’s also more convenient to use for an eCommerce business. Like data gathered from different websites and online shopping applications, a POS also gathers customers’ data through several payment methods to process and record their payments. Since hundreds of customer data are being processed in a POS every day, you must ensure that you have a safe POS system. So what do we need to do to increase the level of our POS security? Here’s what:

Contents

Limit Peope Who Have Access To POS System

Whether you own an online store or a brick-and-mortar store, you will need staff to help you manage the business every day. Of course, some employees will be in charge of the POS system, and although you have done thorough background checks, you should never be complacent with them. It’s basic knowledge that the more people know, the higher the risk for something to get exploited. Limiting access to your POS system will not only lessen the risk of information getting exploited. In case an issue arises, you won’t have to investigate many people. You can find out who’s at fault quicker than going through multiple hands pointing their fingers at each other, making the investigation more time-consuming than it should be.

If you will assign more than three people to your POS system, make sure to give them user-level access or give them user-level permissions before allowing someone to use the POS system.

Train Managers and Employees Who Have POS Access To Phishing

Phishing is a malicious online action used for stealing user data such as credit card numbers and login credentials. Phishing is usually done by sending an email tailored to the target, and it becomes successful if the target’s device lacks software updates that result in a vulnerable security system.

Constantly updating your security system while making sure that all employees who have access to the POS system are well-educated to phishing can lessen the risk of becoming a victim of this social engineering attack and prevent exploitation of customer data.

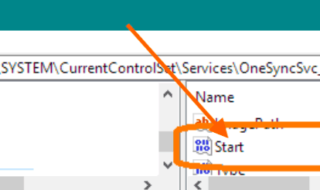

Regularly Update Your POS Software

To lower the chances of getting hacked, ensure that your POS software gets regularly updated. Softwares get regular updates to improve the system by adding more helpful features and mending software vulnerabilities to prevent data exploitation to hackers.

End-to-end Data Encryption

Some companies offer tools that prevent your customer data from being exposed to hackers, whether the hackers have installed malware. The tools will encrypt data from a credit or debit card right when the payment starts processing. This process is called the point-to-point encryption process. The information gathered from the credit or debit card will not even pass by the POS unit, which prevents the data from being vulnerable to any social engineering attack.

Do Not Connect Your POS System To An External Network

Professional hackers can infiltrate systems anywhere they are. They do not need to be in the same office location as their target to compromise the system. Systems connected to external or public networks are more vulnerable to social engineering attacks. One dangerous strategy of hackers is setting up their public network, so once a potential target has connected to their faux network, they will compromise the system through it.

Most traps set by hackers are lying dormant until a POS system suddenly connects to it, then they will start the hacking process without the target even being aware of it. It only takes hackers several minutes to get every data they need from you, so do not ever attempt connecting your POS to an external internet provider. It will be safer to have your private internet connection protected by a VPN.

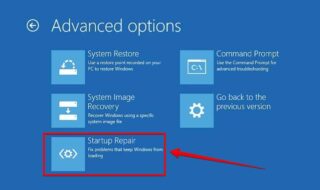

Lock Down All POS System sand Devices

You might think it’s unnecessary to lock down all your systems every day if you use them every day. News flash, it’s not. It is highly relevant that you lock down your systems and devices connected to your POS system after the end of a shift. There have been cases of stolen data because of misplaced and stolen POS devices.

Conclusion

You can only imagine how much trouble it will cost businesses if customer data gets stolen and compromised under their care. Not only will it tarnish the reputation of the business, but it may even lead to serious legal actions.

It is a requirement for businesses to have strong security systems, especially for financial software such as a POS system. Ensuring that your security is unbreachable will not only prevent problems from arising but will also provide a better service to customers.